September 2013 Market Update: With the last few weeks of the 3rd quarter upon us, let’s check in on the how the Big Bear real estate market has fared over the summer.

A Solid Increase in Average Price

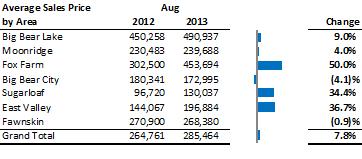

August 2013, as compared to August 2012, saw a solid 8% increase in average price. This was certainly an encouraging outcome as the market was looking for direction after somewhat underwhelming results in June and July (in which average sales prices were -1% and +2% respectively). Here in Big Bear, the months of August and September are typically good indicators of what direction the market will take in the 4th quarter. A strong month was needed to set the Big Bear real estate market up for a solid finish to 2013 and to consolidate the appreciation we witnessed in the first quarter. And, that is just what we got.

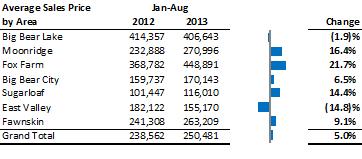

A couple of additional and interesting notes on year-to-date price appreciation in a few different areas of Big Bear: Moonridge year-to-date-has seen an impressive 16.4% increase in average price. The Fox Farm area is up a whopping 21.7% and Sugarloaf has also been on the rise with a very respectable 14.4% gain.

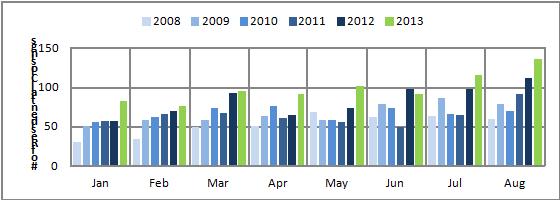

Number of Sales Up Substantially

In addition to price, the number of sales was up substantially as well. August 2013 saw a 21% increase in residential closings as compared to 2012. Year-to-Date sales are up overall an impressive 18.7%.

A couple of additional and interesting notes on year-to-date transactions: Big Bear City saw a 31% increase in sales from last year and Fox Farm recorded 33% more. Also interesting, in describing demand for real estate in Big Bear, the number of closings in the price range $250,000 - $500,000 increased a remarkable 57%.

Demand-Side Sees Momentum

So, after the market took a bit of a break early in the summer, primarily due to the sudden increase in interest rates (which are still at historically low levels), the market has regained some traction. I think, based on current supply and historical price data detailed below, this newly found momentum will carry nicely into the 4th quarter.

Inventory Remains Tight

On the supply side inventory has increased from rock bottom levels seen in the spring but still remains tight. There are currently 513 active residential listings on our Big Bear MLS. Based on the current number of homes in escrow this equates to a 4 ½ month supply. I expect this level of supply to remain at current levels and eventually decrease, as the fall progresses into winter.

Looking Forward…

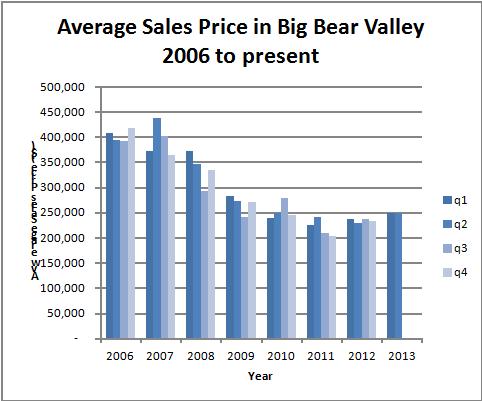

In order to put forth an educated guess on where the real estate market in Big Bear is heading, let’s take a look at from where it has come…

At the very height of the market, the beginning of 2007, the average price in Big Bear Valley peaked at roughly $425,000. This was a 100% increase from the average at the end of 2001. From the lofty heights of 2007, we experienced a long and unprecedented slide back to those 2001/2002 levels. When looking at the data, the market in Big Bear actually bottomed in the fourth quarter of 2011 when the average price was once again, $202,000. Since then, and as it stands now, the average price has risen roughly 25% to $250,000.

Another way to look at this is that we are ¼ of the way back from the 50% decrease we experienced from 2007 to 2011. Will the next five years see an increase similar to what we experienced from 2002 to 2007? This is doubtful, as qualifying for a purchase loan is, and rightly so, much more difficult than it was then. But is it possible that we could make it halfway back, or over halfway back to those levels? I think that is well within the realm of what is possible. Were we to make it halfway back to the levels seen in 2007, the average price in Big Bear would be just over $300,000, or another 20% up from current levels. I would expect that over the next three years the average price in Big Bear will be in the $325,000 range, meaning that there is some nice upside potential to be had in the real estate market here, especially when considering the enjoyment that a real estate investment in Big Bear can provide you and your family.

There have always been many reasons to consider owning property in Big Bear, and now price appreciation is one of them. Call or email us today to find out more about how to make a Big Bear real investment work for you.