By Mike Sannes, Big Bear Real Estate - The Mike Sannes Team, December 14, 2016

Thanks for checking in with us on the Big Bear real estate market. This year has seemingly flown by once again. With the holiday season right around the corner, let’s get caught up on the happenings in Big Bear’s unique resort market.

Residential Sales Relatively Flat, Shift to Higher Price Continues

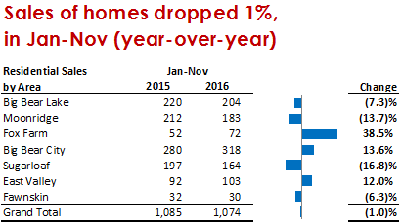

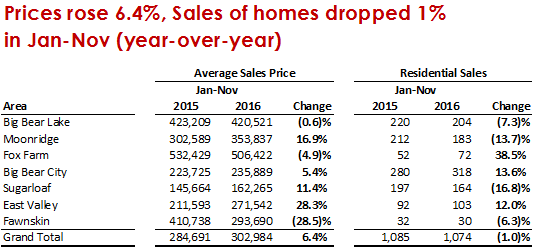

2016 has been a solid year for real estate in Big Bear. The number of residential sales overall (Jan-Nov 2016 vs. the same period last year) was relatively unchanged,

posting a slight decrease of 1% with 1,074 closings in 2016 vs. 1,085 in 2015.

posting a slight decrease of 1% with 1,074 closings in 2016 vs. 1,085 in 2015.

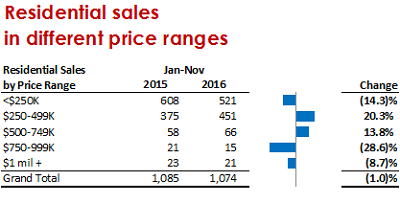

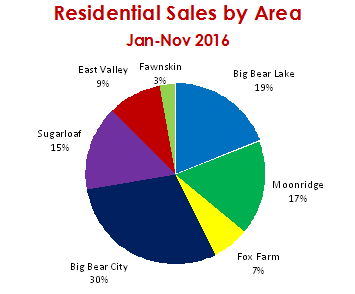

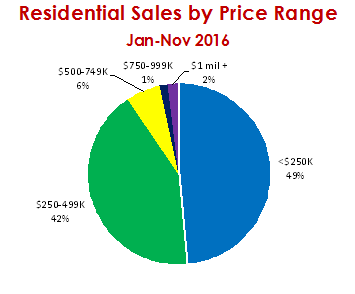

It is interesting to note the distribution of sales in the different areas of Big Bear as well as in different price ranges. The trend we have seen, where the bulk of the demand is moving up from the $0 - $250k price range and into the $250k - $500k price range, is still very much in effect. In fact, 3 years ago, 65% off all residential sales occurred under $250k (and 28% were between $250k -$500k,) whereas now 49% are under $250k and 42% are in the $250k-$500k range.

Although Sales Were Flat, Prices Were Not

The average price of all homes sold this year as compared to last year in the Big Bear Valley showed a healthy 6.4% increase. This appreciation was distributed across different areas of Big Bear, as the chart below shows. Interesting to note is that as the average price of all those sold in Fox Farm dropped 4.9%, the total number of transactions showed a substantial 38.5% increase. Whereas, the average price of all those sold in Moonridge and Sugarloaf increased 16.9% and 11.4% respectively,  the total number of sales in those areas dropped dramatically by 13.7% and 16.8%. My former economics professor at Columbia would point to this as an excellent illustration of supply and demand with respect to price sensitivity in the market.

the total number of sales in those areas dropped dramatically by 13.7% and 16.8%. My former economics professor at Columbia would point to this as an excellent illustration of supply and demand with respect to price sensitivity in the market.

Speaking of Supply

We currently have 441 "active" residential listings on our Big Bear MLS and a total of 162 homes currently “in escrow” which equates to (based on a typical 45-day closing period) a 4-month supply of homes for sale here in Big Bear. This leans towards a “sellers’ market.” That said, it is typical for the number of listings to decrease as we head into the winter months. Prices don’t fluctuate seasonally here in Big Bear, but the number of listings, and with that the number of sales, do follow seasonal trends.

Potential for More Appreciation in the Years to Come

Big Bear’s real estate market has taken quite ride from the all-time highs we saw at the beginning of 2007: To put that into perspective, the average price in Big Bear at the end of 2006 was $400k, whereas in the 3rd quarter of 2011, it was just over $200k. And it now sits at just over $300k. So although we have seen a substantial rebound, there is still potential for more appreciation here in Big Bear in the years to come as we aren’t close to being back to 2007 values. With Mammoth Mountain’s purchase of our two local ski resorts and all the capital improvement that will bring, buying Big Bear, in addition to being a ‘quality of life’ investment, has potential to be a solid real estate investment as well.

2017 will no-doubt be an interesting year for our economy overall and for the Big Bear real estate market in particular. With interest rates on the rise, it will be interesting to see what impact, if any, that has on prices as the year develops. We will keep you posted with our blog; also, our website at www.realestate-bigbear.com has updated market info for you as well. If you, or anyone you know, is interested in buying or selling real estate here in Big Bear, we look forward to hearing from you. Until next time… Happy Holidays!! And we hope 2017 is a happy, healthy and prosperous new year for you and yours.