By Mike Sannes, Big Bear Real Estate - The Mike Sannes Team, June 16, 2017

Hello and thanks for checking in with us. It is hard to believe, but almost half of 2017 has already passed us by, so let’s get caught up on the Big Bear real estate market.

Demand Remains Strong…

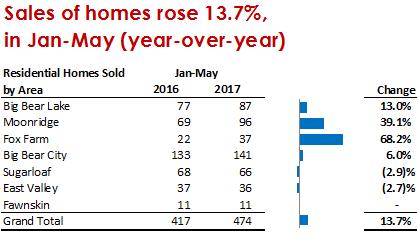

In the first five months of 2017 (Jan - May) There were 474 closed residential sales here in Big Bear vs. 417 closings over the same period in 2016. That equates to an impressive 13.7% increase in closed sales so far this year. The month of May itself (116 in 2017 vs 85 in 2016) saw an extraordinary 36% increase in residential sales. Certainly, a remarkable start to the year. In fact, we have not seen this number of closings in the first five months of any year since 2008.

equates to an impressive 13.7% increase in closed sales so far this year. The month of May itself (116 in 2017 vs 85 in 2016) saw an extraordinary 36% increase in residential sales. Certainly, a remarkable start to the year. In fact, we have not seen this number of closings in the first five months of any year since 2008.

… And Has Kept Pace with Rising Supply

Furthermore, while the supply of homes for sale in Big Bear is on the rise -- as of June 8th, there were 471 active residential listings vs. 379 on April 17th, a seasonal increase in supply that is par-for-the-course for this time of year -- the increase in demand has so far kept pace. Based on the number of homes currently in escrow (176) and given a typical 45-day closing period, we still have a 4-month supply of homes on the market. So, even with the recent increase in number of listings, we are still looking at a “seller’s market.” It will be interesting to see, given the dramatic number of new listings currently coming to market, if this trend of demand keeping pace with increasing supply will continue to hold. At the current rate of increase I expect supply to gradually outpace demand. By mid-July and into August, I expect we will see closer to 6 months of inventory on the market, which, by definition, would be more of a “balanced” market. It looks doubtful to me that we will see a “buyer’s market” this year, where supply edges into the 7- to 8-month range. Stay tuned, and we shall see.

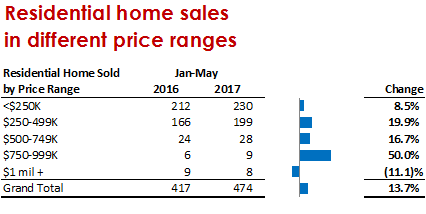

Composition of Closed Sales

Of note on the closed sale side: 23% of those deals were cash. From a percentage perspective, Fox Farm (up 68.2%) and Moonridge (up 39.1%) saw th e biggest increase in number of sales. And it is interesting to see that 5% (which equates to 26 vs. basically 0 a few years back) of our “Active” inventory is either “New” or “Under Construction.” It is certainly good to see some building underway. If you would like info on the new log-style homes being built, or any others for sale here in Big Bear, do let us know.

e biggest increase in number of sales. And it is interesting to see that 5% (which equates to 26 vs. basically 0 a few years back) of our “Active” inventory is either “New” or “Under Construction.” It is certainly good to see some building underway. If you would like info on the new log-style homes being built, or any others for sale here in Big Bear, do let us know.

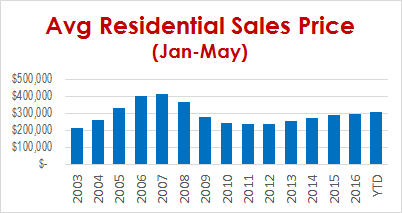

Average Price Holds at over $300K

The average price of all residential homes sold Jan-May 2017 was $305,961, making this the first year in almost 10 years to see an average price holding at over $300,000.  So far this year (Jan-May 2017 vs. Jan-May 2016), the average price of all homes sold has increased a total of 2.4%. So, the appreciation in the Big Bear real estate market, although evident, remains slow and steady (a.k.a. solid and healthy) making this summer a great time to buy or sell in Big Bear.

So far this year (Jan-May 2017 vs. Jan-May 2016), the average price of all homes sold has increased a total of 2.4%. So, the appreciation in the Big Bear real estate market, although evident, remains slow and steady (a.k.a. solid and healthy) making this summer a great time to buy or sell in Big Bear.

Changing Interest Rate Environment

It is impossible to predict the future, but the Fed just raised their short-term Fed-Funds rate another .25% (the 3rd increase in the last 6 months) and they have stated that they intend to see that rate (currently between 1%-1.25%) at 3% in 2019. If these short-term rate increases translate into the longer-term bond and mortgage markets (which they typically do), we could see 30-year fixed mortgage rates at or pushing 6% in 2019 (vs. the rock bottom 4% or under at present). Seems to me to be a good time to lock in a great rate on the right piece of real estate in Big Bear. Whether you’re interested in buying or looking to sell, we look forward to hearing from you regarding how we can help. Thanks, and until next time: All the Best and Happy Hunting.