Q2-2020 Market Update by Mike Sannes, Big Bear Real Estate - The Mike Sannes Team, July 25, 2020

Hello to you all and as always, thanks for checking in with us regarding the Big Bear real estate market. What an amazing few months it has been since my last update. Since the end of the first quarter in March, the Big Bear real estate market has been on an absolute roller coaster ride. And as these long days of summer keep flying right by, let’s take a minute and get caught up on how the COVID-19 pandemic has been affecting Big Bear’s unique vacation home market.

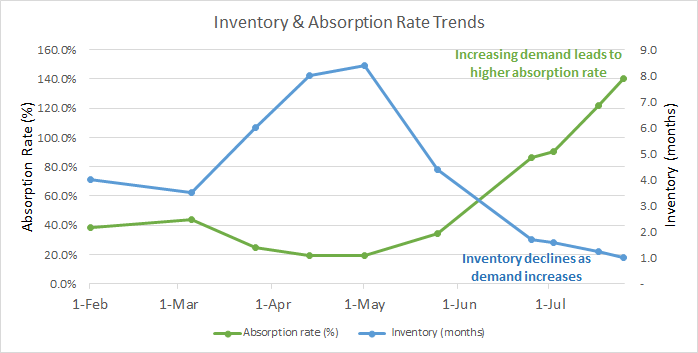

April, which is typically a slow month for sales here in Big Bear, started off as slower than molasses on a very cold day. On April 15th, we had 390 active listings and 74 homes in-escrow which translates to a 19% absorption rate* and equates to 8 months of inventory.** How bad was it? The total number of sales in April 2020 vs. April of 2019 was off by 58% (45 in 2020 vs. 108 in 2019) and was also off by 54% from the 5-year average number of closings (97) in the month of April.

These market conditions held through mid-May but by the end of May, a dramatic shift was underway with the absorption rate on the rise to 34% leading to only 4.4 months of inventory (394 active listings vs. 134 homes in-escrow.) Which for reference, is about where we were in February of 2020, prior to the pandemic taking effect.

As the chart below illustrates, this dramatic shift in demand -- which could aptly be described as a tidal wave of demand given the steep rise in the number of homes in-escrow -- continues to build. By the end of Q2 in June, we witnessed an unheard of 90% absorption rate and had under 2 months of inventory (308 Active listings vs. 270(!) in-escrow) -- truly unprecedented.

What does this all mean for the real estate market here in Big Bear going forward? I have been selling real estate here in Big Bear since 2004 and, even in the hey-day of the bubble market in 2006, I have never witnessed there being substantially more properties in-escrow than there are active listings (312 in-escrow vs. 223 active currently). And in talking with a few old-timers that have been in this business here since the 80’s, this dynamic does indeed seem to be historically unprecedented. It is safe to say that the Big Bear real estate market has never seen anything even close to the level of demand we are currently experiencing and the reasons for this I think are many, including:

- Big Bear’s affordability vs. down-the-hill pricing

- A 3% fixed rate on 30-year mortgages

- The move for many towards continuing to work remotely

- The trend of not hopping on planes as the preferred method of travel

- The increasing desire to be able to distance oneself from others, coupled with the social unrest many urban areas have recently experienced

The list goes on and only time will tell if the desire and ability of people to move to and live in more rural areas, father away from populated cities will continue. But in the meantime, it all adds up to increased demand for Big Bear: being a unique four-season alpine resort located within a 3-hour drive (or less) from roughly 20 million people, being a very popular destination and also as very attractive place to invest in real estate that can be used, enjoyed and perhaps vacation rented in order to offset expenses.

Please do let us know if you have any questions on the market overall or ANY properties that you see for sale here in Big Bear, as we have access to ALL listings and look forward to putting our local knowledge and expertise to work for you.

Until next time, happy hunting! If for any reason, you have considered selling your Big Bear property anytime in the last few years, opportunity is knocking as there are currently many more buyers than there are homes for sale. Juts let me know if you would like to understand the current value of your Big Bear property as we are happy to help and always look forward to hearing from you.

____________________

*Absorption Rate: The number of homes in-escrow / the number of active listings. Which shows the percentage of the inventory that gets ‘absorbed’ (a.k.a. sold) in a given escrow period (typically 45 days) Considered the ‘speed of the market’. Historically in Big Bear 20% or less is a very slow market with weak demand. Whereas 50%, (where half of the active inventory is being sold in a 45 day period) or thereabouts is a very fast market with very strong demand.

**Months of Inventory: The time it would take, based on a typical 45-day closing period, for all the active listings on the market to sell, if there were no new listings. Four or less months is viewed as a strong “Sellers Market.” Six months is considered a balanced market and 8 months or more is considered a strong “Buyers market.”

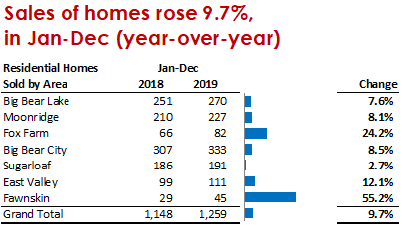

2019 was solid year for the

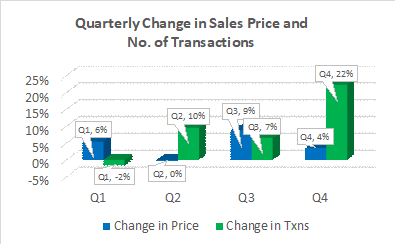

2019 was solid year for the  2019 ended with a bang, as the month of December saw an astounding 55% jump in closed sales! (119 in 2019 vs. 77 in 2018 and vs 105 in Nov. 2019) The chart to the left shows the Quarter-by-Quarter change in both average sales price and number of sales for 2019.

2019 ended with a bang, as the month of December saw an astounding 55% jump in closed sales! (119 in 2019 vs. 77 in 2018 and vs 105 in Nov. 2019) The chart to the left shows the Quarter-by-Quarter change in both average sales price and number of sales for 2019.

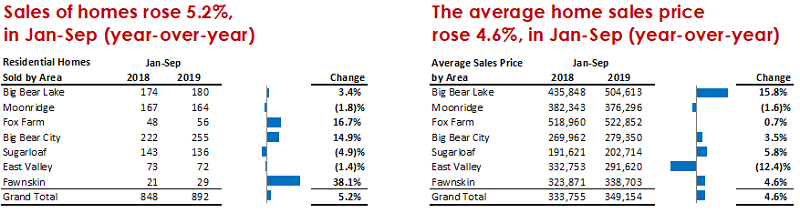

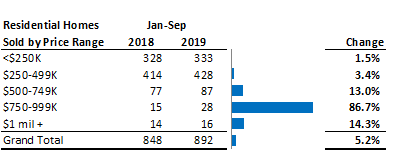

The biggest surprise, when looking at the distribution of sales by price range, has been between $750,000 and $999,000. In the first 9 months of 2019, closings in this price range were up an amazing 86.7%! (15 in 2018 vs. 28 in 2019) Wow, quite a few happy sellers in that group! And it is encouraging to see, as this is a price range that has been very slow to sell in recent years.

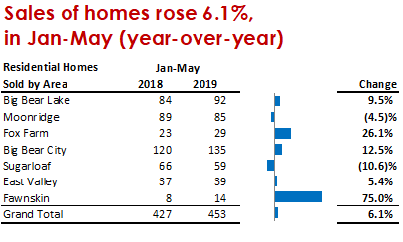

The biggest surprise, when looking at the distribution of sales by price range, has been between $750,000 and $999,000. In the first 9 months of 2019, closings in this price range were up an amazing 86.7%! (15 in 2018 vs. 28 in 2019) Wow, quite a few happy sellers in that group! And it is encouraging to see, as this is a price range that has been very slow to sell in recent years. There has been an impressive 6.1% increase in transactions (Jan - May 2019 vs same period of 2018). Low interest rates are strengthening demand and should continue to do so for at least the remainder of this year. (April, typically a slow month for sales here in Big Bear, saw a whopping 46% increase in transactions: 74 in 2018 vs 108 in 2019.)

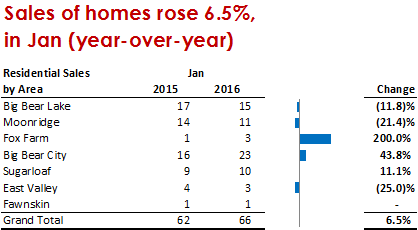

There has been an impressive 6.1% increase in transactions (Jan - May 2019 vs same period of 2018). Low interest rates are strengthening demand and should continue to do so for at least the remainder of this year. (April, typically a slow month for sales here in Big Bear, saw a whopping 46% increase in transactions: 74 in 2018 vs 108 in 2019.)  Residential sales in Big Bear jumped 3.2% in January compared with the same month a year earlier, and 6.5% year-over-year. A boost in sales in Big Bear City (up 43.8% compared to January 2015) contributed the bulk of this increase. In January, 66 homes closed escrow up from 62 in January of 2015. However, January 2016 sales are down 43% from December 2015, when 115 homes closed escrow. That said, it is typical for sales to slow in the winter months here in Big Bear.

Residential sales in Big Bear jumped 3.2% in January compared with the same month a year earlier, and 6.5% year-over-year. A boost in sales in Big Bear City (up 43.8% compared to January 2015) contributed the bulk of this increase. In January, 66 homes closed escrow up from 62 in January of 2015. However, January 2016 sales are down 43% from December 2015, when 115 homes closed escrow. That said, it is typical for sales to slow in the winter months here in Big Bear.