November 2018 Market Update by Mike Sannes, Big Bear Real Estate - The Mike Sannes Team, November 9, 2018

Hello from Big Bear and thanks for checking in with us regarding Big Bear real estate. There is quite a bit to catch up on since our early summer update, so let’s dive right in.

What a roller coaster ride 2018 has been for the Big Bear real estate market. If you recall, we ended the 1st quarter (Q1 market update) with a solid 10.8% year-over-year average sales price gain. The perfect storm of historically low supply, combined with higher than normal demand for that time of year due to our complete lack of a snow-filled winter, fueled the 1st quarter increase. In fact, by the end of May the increase in the average sales price here in Big Bear peaked at 15% (3% a month for 5 months straight!). ...continue reading

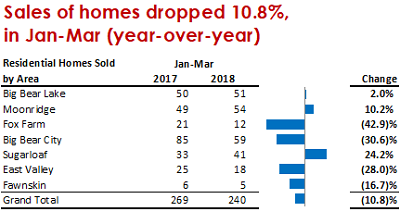

First, fewer homes sold in the first quarter of this year (Jan-March), then sold in the same period of 2017. In fact, closed residential sales for the first quarter of 2018 were off a substantial 10.8% vs. 2017 (240 in 2018 vs 269 in 2017). The primary reason for the decline in the number of homes sold was a lack of well-priced homes for sale.

First, fewer homes sold in the first quarter of this year (Jan-March), then sold in the same period of 2017. In fact, closed residential sales for the first quarter of 2018 were off a substantial 10.8% vs. 2017 (240 in 2018 vs 269 in 2017). The primary reason for the decline in the number of homes sold was a lack of well-priced homes for sale.