Q3 Market Update by Mike Sannes, Big Bear Real Estate - The Mike Sannes Team, October 10, 2017

"Wow" is one of the first words that comes to mind when looking at what transpired in the 3rd quarter in Big Bear's real estate market. Historically, the 3rd quarter is always the busiest of any given year, but this year... wow.

From January through July 2017, when compared to the same period in 2016, the Big Bear real estate market realized a 15.7% increase in total number of residential sales and a 2.3% gain in average sale price. This certainly qualifies as a solid result for the first seven months of the year. However, ...continue reading

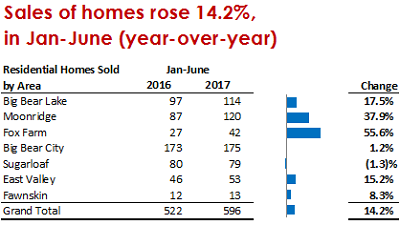

The story so far in 2017 has been one of healthy demand for Big Bear vacation homes. The total number of residential sales from January through June 2017 vs. the same period in 2016 increased a substantial 14.2% (596 in 2017 vs. 522 in 2016).

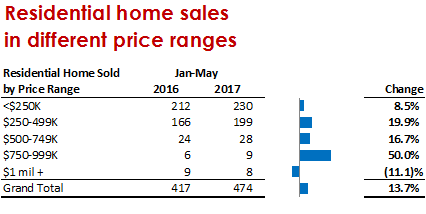

The story so far in 2017 has been one of healthy demand for Big Bear vacation homes. The total number of residential sales from January through June 2017 vs. the same period in 2016 increased a substantial 14.2% (596 in 2017 vs. 522 in 2016).  equates to an impressive 13.7% increase in closed sales so far this year. The month of May itself (116 in 2017 vs 85 in 2016) saw an extraordinary 36% increase in residential sales. Certainly, a remarkable start to the year. In fact, we have not seen this number of closings in the first five months of any year since 2008.

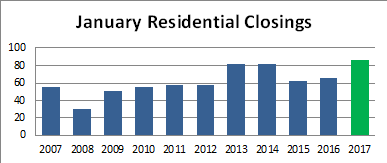

equates to an impressive 13.7% increase in closed sales so far this year. The month of May itself (116 in 2017 vs 85 in 2016) saw an extraordinary 36% increase in residential sales. Certainly, a remarkable start to the year. In fact, we have not seen this number of closings in the first five months of any year since 2008.  d as there were 86 residential closings as compared to 66 in January 2016, an incredible 30.3% increase! In fact, the 86 closings we saw this January are the most sales we have seen in the month of January in over 10 years.

d as there were 86 residential closings as compared to 66 in January 2016, an incredible 30.3% increase! In fact, the 86 closings we saw this January are the most sales we have seen in the month of January in over 10 years.